By Matthew H.

Published:

| Updated:

Hong Kong – Eric Trump delivered a rousing endorsement of Bitcoin's future potential at Bitcoin Asia 2025, marking his first appearance at a major Asian cryptocurrency conference and signaling the Trump family's expanding crypto empire's eastward push into the world's largest digital asset markets.

Speaking to over 17,000 attendees at the Hong Kong Convention and Exhibition Centre on August 29, the Executive Vice President of the Trump Organization and co-founder of American Bitcoin declared that Bitcoin would "ultimately reach $1 million" while describing the digital asset as "the greatest store of value in human history".

"Bitcoin Takes Over The World"

Eric Trump's keynote presentation, aptly titled "Bitcoin Takes Over The World," served as both a passionate advocacy for cryptocurrency adoption and a strategic positioning statement for the Trump family's rapidly expanding digital asset ventures.

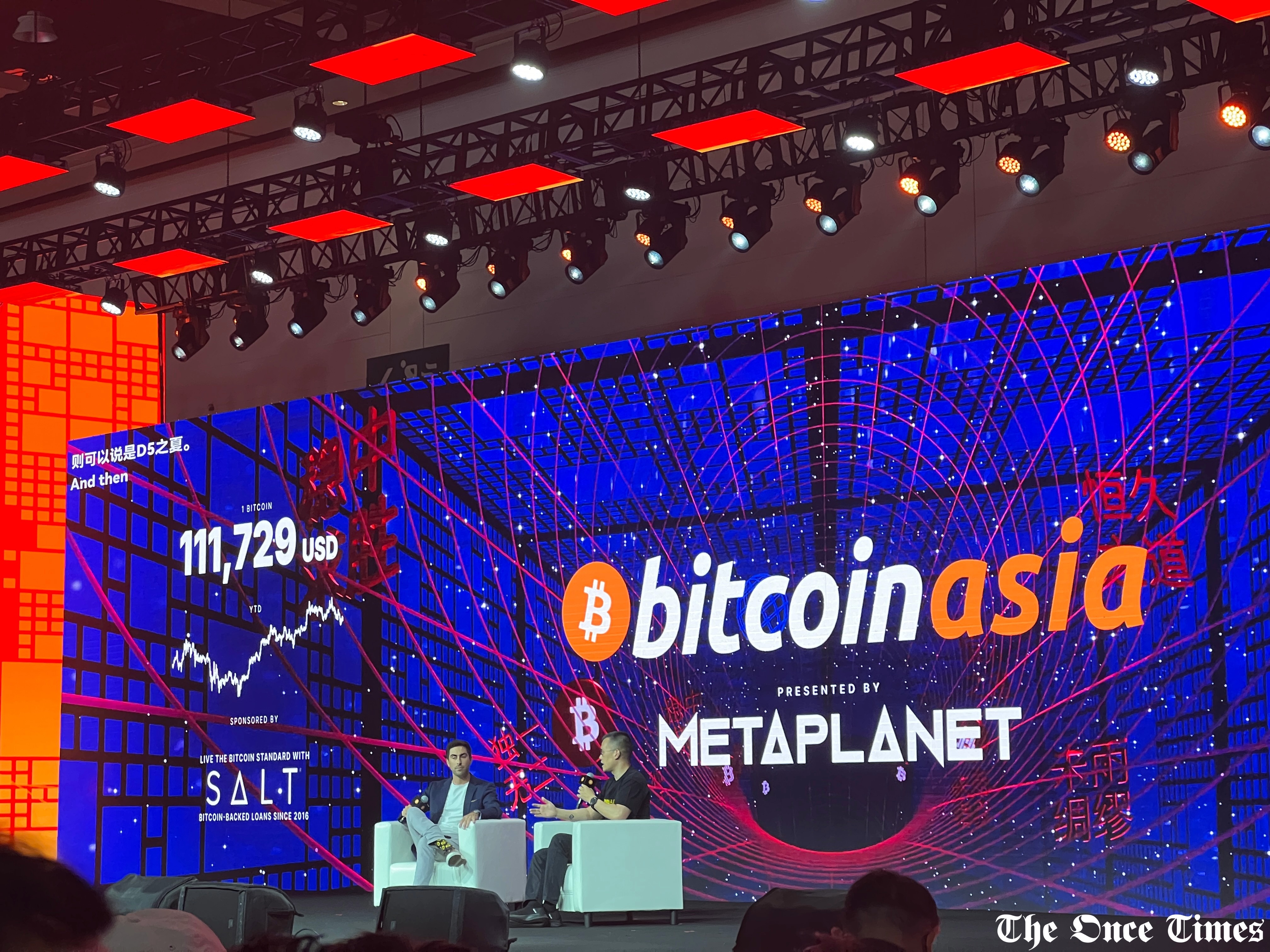

"I truly believe that in the coming years, Bitcoin will achieve a million-dollar value. There is no doubt about it," Trump stated to the packed auditorium, with Bitcoin's real-time price of over $110,000 displayed prominently behind him. "Invest now, close your eyes for the next five years, and you will see remarkable returns."

The appearance represents a significant milestone in the Trump family's crypto journey, which has accelerated dramatically since President Trump's electoral victory. "The Bitcoin community has supported my father in a way I have never witnessed before," Eric Trump noted, adding that he dedicates "90% of his time to interacting with the crypto community".

CZ Echoes Bold Predictions

Bitcoin Asia 2025 also featured Binance founder Changpeng "CZ" Zhao, who delivered equally bullish projections about Bitcoin's institutional future. "Bitcoin will become the global reserve currency, and countries are adopting it," CZ declared to the conference audience.

The former Binance CEO emphasized that this transformation extends beyond speculation, pointing to government adoption, corporate treasury strategies, and the proliferation of Bitcoin ETFs as evidence of institutional acceptance. "Equity markets now have access to crypto, and we're bringing real-world assets into crypto. This is fantastic," Zhao explained.

CZ's remarks come as Asia accounts for 43% of global cryptocurrency ownership, with Hong Kong leading regulatory innovation through its recently approved Bitcoin and Ethereum ETF frameworks.

American Bitcoin's Market Debut

Eric Trump's Hong Kong appearance coincided with the highly anticipated Nasdaq debut of American Bitcoin (ABTC), the mining and treasury company he co-founded with brother Donald Trump Jr. The firm began trading on September 3 under the ticker "ABTC," opening at $6.90 before surging 60% to over $11 in early trading.

American Bitcoin, formed through a merger with Gryphon Digital Mining and backed primarily by Canadian mining firm Hut 8, represents a hybrid model combining Bitcoin mining operations with a corporate treasury strategy focused on accumulating the digital asset. Since inception, the company has amassed 2,443 Bitcoin worth approximately $160 million at current prices.

"Our Nasdaq launch signifies a pivotal achievement in integrating Bitcoin into the heart of U.S. capital markets," Eric Trump stated in a press release announcing the listing. The company immediately filed for an at-the-market equity raise of up to $2.1 billion to continue building its Bitcoin reserves.

Asian Expansion Strategy

The conference appearance signals American Bitcoin's strategic interest in Asian market expansion. During his Hong Kong visit, Eric Trump specifically praised China and Hong Kong's role in the cryptocurrency ecosystem, calling them "an undeniable force" in the crypto world.

Following the conference, Eric Trump traveled to Japan for a Metaplanet shareholder meeting, where he serves on the advisory board of the Tokyo-listed Bitcoin treasury company. The brothers are scheduled to appear at additional Asian cryptocurrency events, including Token 2049 in Singapore and a conference in South Korea.

Industry observers note the timing aligns with American Bitcoin's publicly stated interest in potential Asian acquisitions, particularly Japanese companies following the "Bitcoin treasury" model pioneered by firms like Metaplanet, ANAP Holdings, and Remixpoint.

Political Dynamics and Regulatory Context

Eric Trump's Asian tour occurs amid complex political dynamics surrounding the Trump administration's crypto policies and the family's business interests. Hong Kong authorities notably withdrew two officials from the conference following advice to avoid engagement with Eric Trump, highlighting sensitivity around potential conflicts of interest.

The Securities and Futures Commission's executive director Eric Yip and lawmaker Johnny Ng were initially listed as speakers before being removed from the program. The SFC stated Yip was unavailable due to business travel, while Ng cited family reasons for withdrawal.

Despite these political sensitivities, Eric Trump emphasized the importance of Asia in the global cryptocurrency landscape. "Asia's moment. Hong Kong's moment," he declared, positioning the region as central to Bitcoin's continued growth.

Hong Kong as Crypto Hub

The Bitcoin Asia conference reinforced Hong Kong's ambitions to establish itself as a global virtual asset center following its comprehensive regulatory framework implementation in 2024. The city's approach of embracing innovation while maintaining strict oversight has attracted significant industry attention.

"Hong Kong has the conditions to become a major hub for virtual assets, rivalling markets like the US and the United Arab Emirates, but the city's regulators must act swiftly to realize its potential," CZ told the South China Morning Post in an exclusive interview during the conference.

The conference's success, with attendance nearly tripling from the previous year to over 17,000 participants, demonstrates growing institutional and retail interest in cryptocurrency across Asia.

Trump Crypto Empire Expansion

Eric Trump's Hong Kong debut represents the latest expansion of the Trump family's diversified cryptocurrency empire, which now encompasses mining operations, treasury strategies, stablecoins, memecoins, and NFTs across multiple public companies.

Recent developments include the launch of World Liberty Financial's WLFI token, which began trading over the Labor Day weekend and values the Trump family's stake at approximately $6 billion. Trump Media & Technology Group has also adopted a MicroStrategy-style Bitcoin accumulation strategy.

The family's crypto ventures have generated substantial paper wealth, with Eric Trump's American Bitcoin stake alone valued at approximately $548 million based on Bloomberg calculations. This wealth creation occurs as President Trump positions himself as the first "crypto president" after previously expressing skepticism toward digital assets.

Market Impact and Future Outlook

The Trump family's high-profile crypto advocacy continues to influence market sentiment, with Bitcoin maintaining levels above $110,000 amid broader institutional adoption trends. Eric Trump's prediction of $1 million Bitcoin aligns with similar forecasts from other industry leaders, including CZ's recent comments that Bitcoin could reach "$500,000 to $1 million in this cycle".

The success of Bitcoin Asia 2025 has already prompted organizers to announce the conference's return to Hong Kong in August 2026, with expectations for even greater institutional participation and policy dialogue.

As the Trump administration implements crypto-friendly policies including stablecoin legislation and strategic Bitcoin reserves, the family's business interests remain closely watched for potential regulatory and market impacts.

The convergence of political influence, business interests, and technological innovation demonstrated at Bitcoin Asia 2025 suggests cryptocurrency's continued evolution from speculative asset to institutional infrastructure, with Asia playing an increasingly central role in this transformation.

A BIG shoutout to HONG KONG! We will be back here for Bitcoin Asia 2026! See you soon!