Crypto & Blockchain

Exclusive | Solana's Asia Playbook Spans Hong Kong, Japan and Korea

Consensus Hong Kong panel maps regulated routes to adoption—from Korea's institutional products to Hong Kong tokenization and Japan's reform roadmap

3 MIN READ

By Matthew H.

Published:

| Updated:

Day 1 wrap

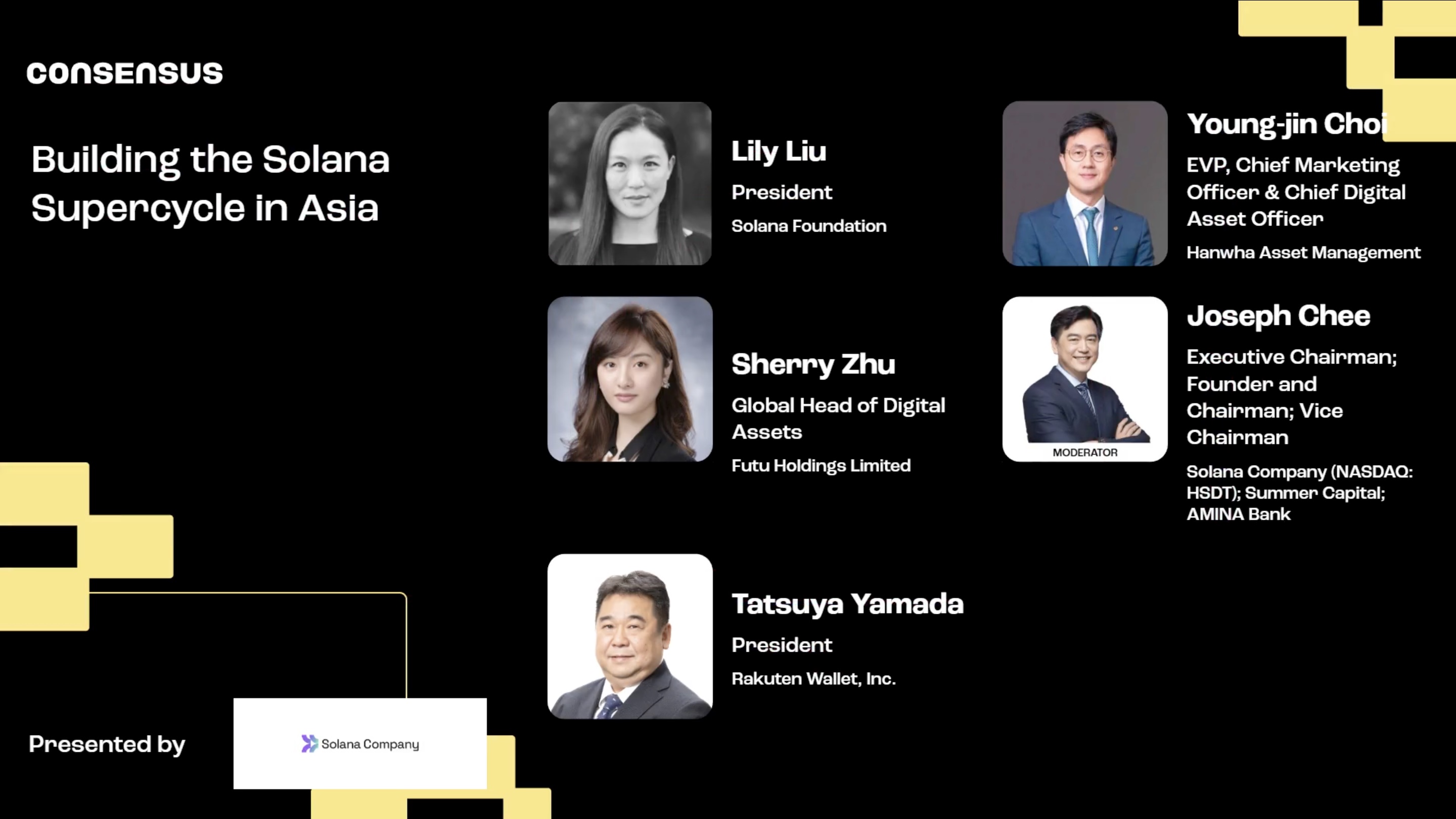

That's a wrap for Day 1 at Consensus Hong Kong! There is no shortage of sharp debate on where digital assets in Asia are headed. One session stood out for its market-by-market detail: "Solana Ecosystem Development in APAC," featuring Solana Foundation President Lily Liu, Hanwha Asset Management's Young-jin Choi, Futu's Sherry Zhu, and Rakuten Wallet President Tatsuya Yamada.

The panel's shared framing was optimistic: Asia's next phase of growth is likely to be driven by clearer rules, more institution-ready infrastructure, and products that connect on-chain networks to familiar financial channels. In that picture, Solana's bet is that speed, usability and a broad developer base can translate into real distribution in the region's major markets.

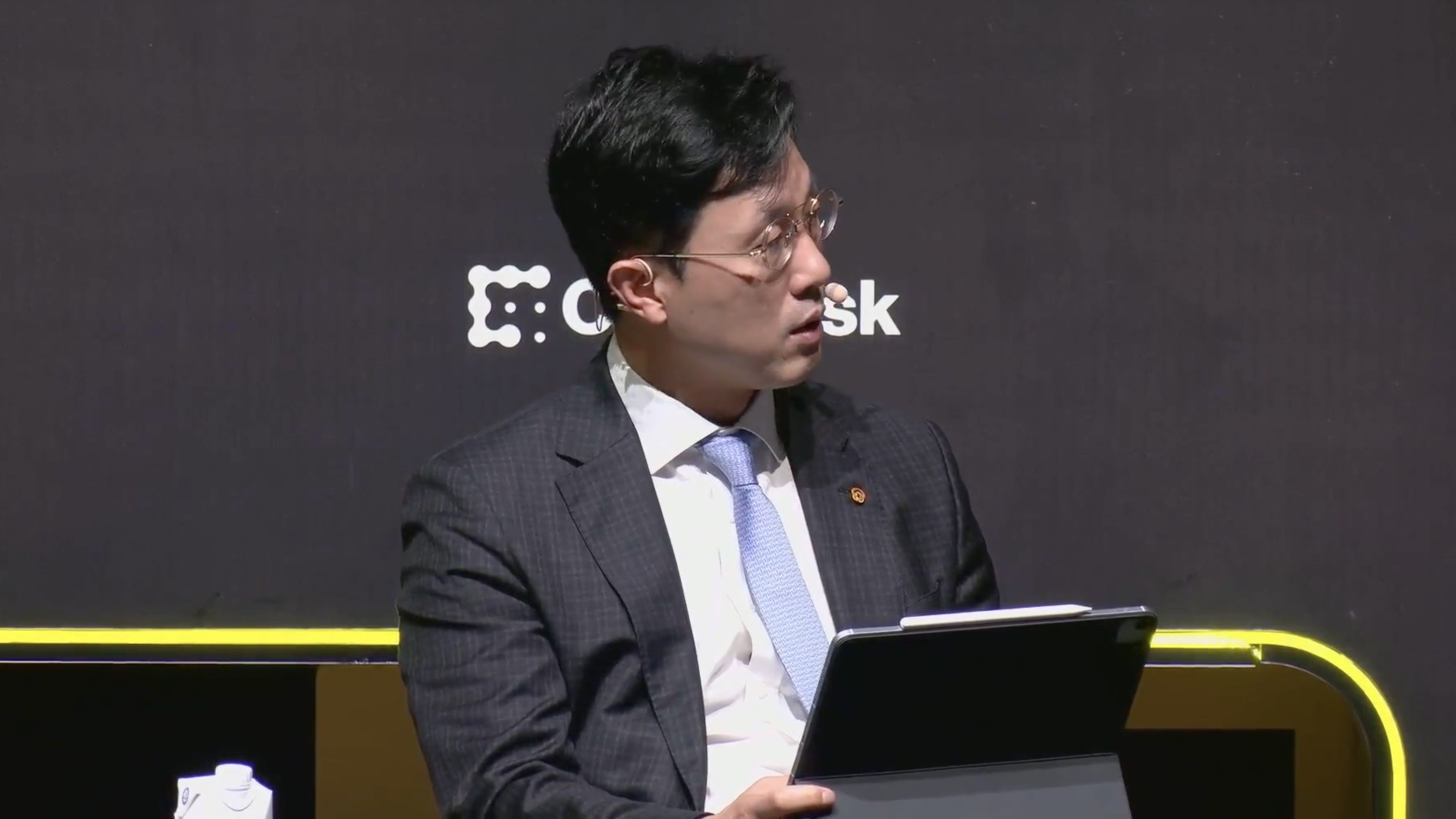

Korea's institutional ramp

Choi positioned Korea as a market where retail participation is already deep, and where the next unlock is bringing more of the financial system into compliant digital-asset exposure. He described institutional rails—product wrappers, custody standards and market infrastructure—as the critical bridge from trading-heavy activity to broader adoption.

That narrative is reinforced by Hanwha Asset Management's recently announced memorandum of understanding with the Solana Foundation, aimed at expanding Solana's presence in Korea and advancing initiatives such as Solana-based exchange-traded products and related infrastructure.

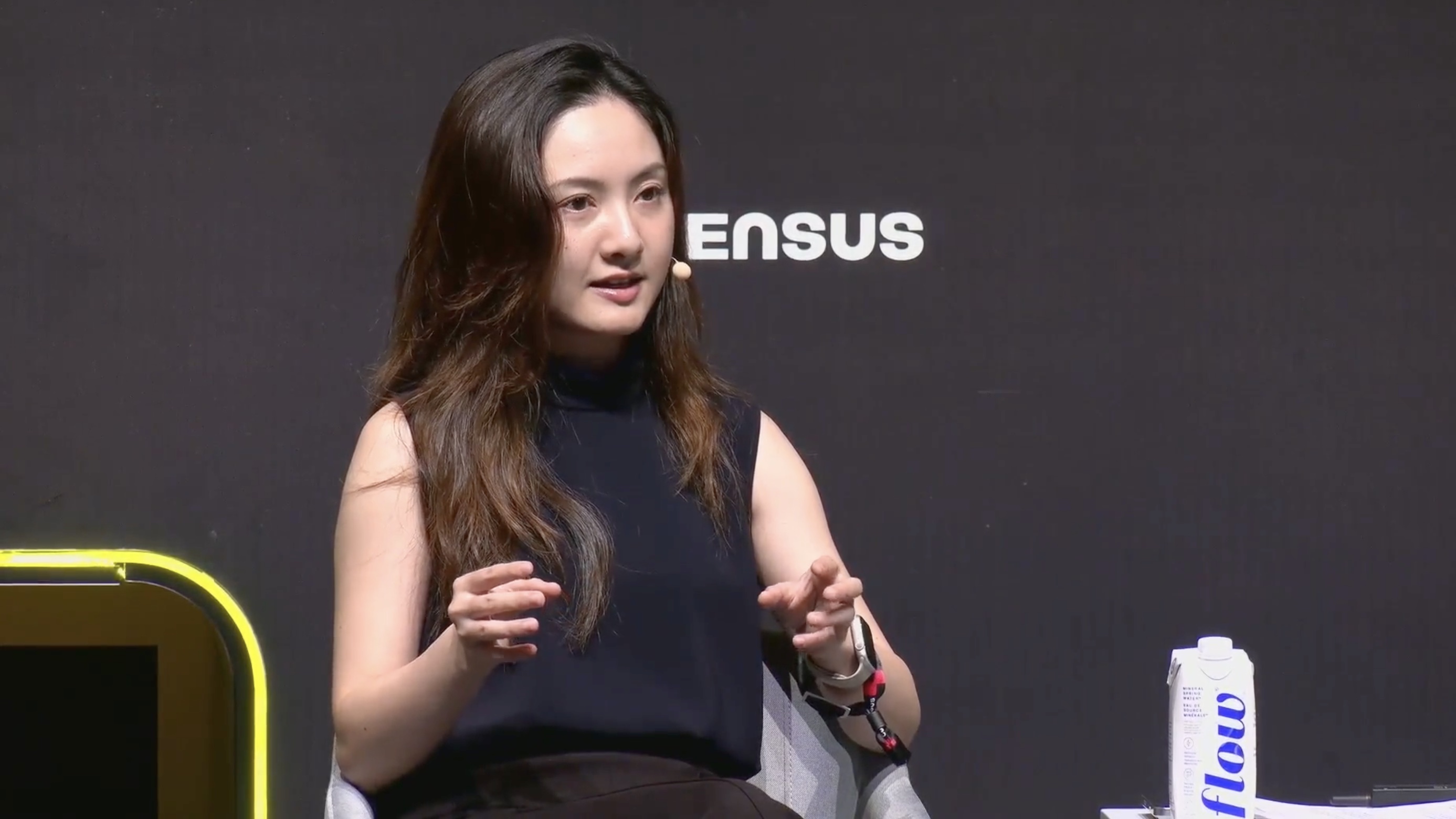

Hong Kong's clarity advantage

Zhu's argument for Hong Kong was straightforward: regulatory clarity and consistency can be a competitive edge, especially for tokenization and compliant on-chain products. She pointed to the city's "same business, same risk, same rules" approach as a reason issuers and intermediaries can plan longer-term, rather than guessing where the rulebook will land.

On tokenization specifically, Hong Kong's Securities and Futures Commission has set out expectations for tokenised SFC-authorised investment products, including conditions under which such products may be offered to the public.

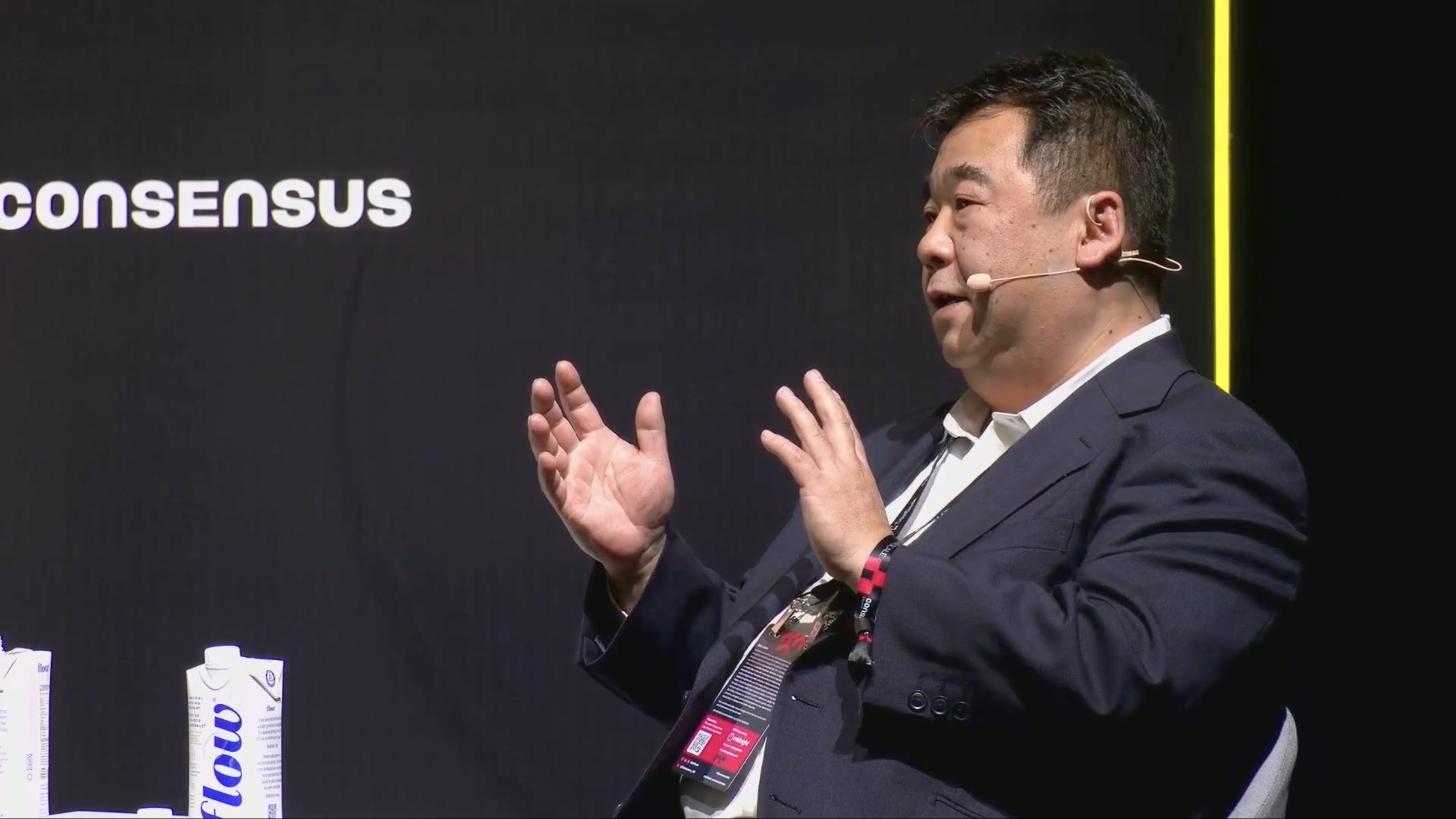

Japan's structured roadmap

Yamada described Japan as pursuing a deliberate, rules-first pathway—one that could open the door to broader participation as regulatory and market reforms evolve. He emphasized that aligning crypto more closely with mainstream financial products is meant to shift usage beyond purely capital-gains trading and toward wider, regulated participation.

Rakuten Wallet, for its part, operates within Japan's regulated framework and has completed registration as a cryptocurrency exchange service provider, underscoring the market's emphasis on licensed operators and consumer protections.

Beyond trading: tokenization and AI themes

Across markets, the panel returned to tokenization and real-world assets (RWA) as a near-term focus, particularly where regulated distribution and familiar investment formats can accelerate adoption. Zhu said that, from a brokerage-led perspective, RWA aligns naturally with how clients move from trading into longer-horizon investing products.

Liu also highlighted the longer-arc opportunity at the intersection of crypto and AI—where software agents may transact with each other using programmable money and stablecoins—arguing that new "internet-native" markets could become as important as putting traditional assets on-chain. The upbeat takeaway: Asia's Solana story is being built through multiple lanes at once—institutions, regulation, product packaging, and new use cases—rather than any single trend.

With Day 1 in the books, attention now turns to Day 2's lineup. If Wednesday's sessions are any indication, Consensus Hong Kong is delivering the kind of granular, market-focused conversations that matter for builders, institutions and policymakers navigating Asia's evolving digital-asset landscape.

The Once Times is an Official Press of Consensus Hong Kong 2026 and Solana Accelerate APAC 2026.