Crypto & Blockchain

Exclusive | Privacy in the Age of Agents: Why Implicit Trust is No Longer Enough for Global Commerce

Beyond the Click: How Mastercard, DNP, and Terminal 3 Are Building the Rails for Autonomous Finance

5 MIN READ

By Matthew H.

Published:

| Updated:

HONG KONG — The promise of the "Agentic Economy" is seductive: a digital assistant that doesn't just answer questions but actively navigates the world—booking flights, negotiating prices, and executing payments while its human owner sleeps. But beneath this vision lies a precarious infrastructure gap that industry leaders warn is nowhere near ready for the sheer scale and speed of autonomous commerce.

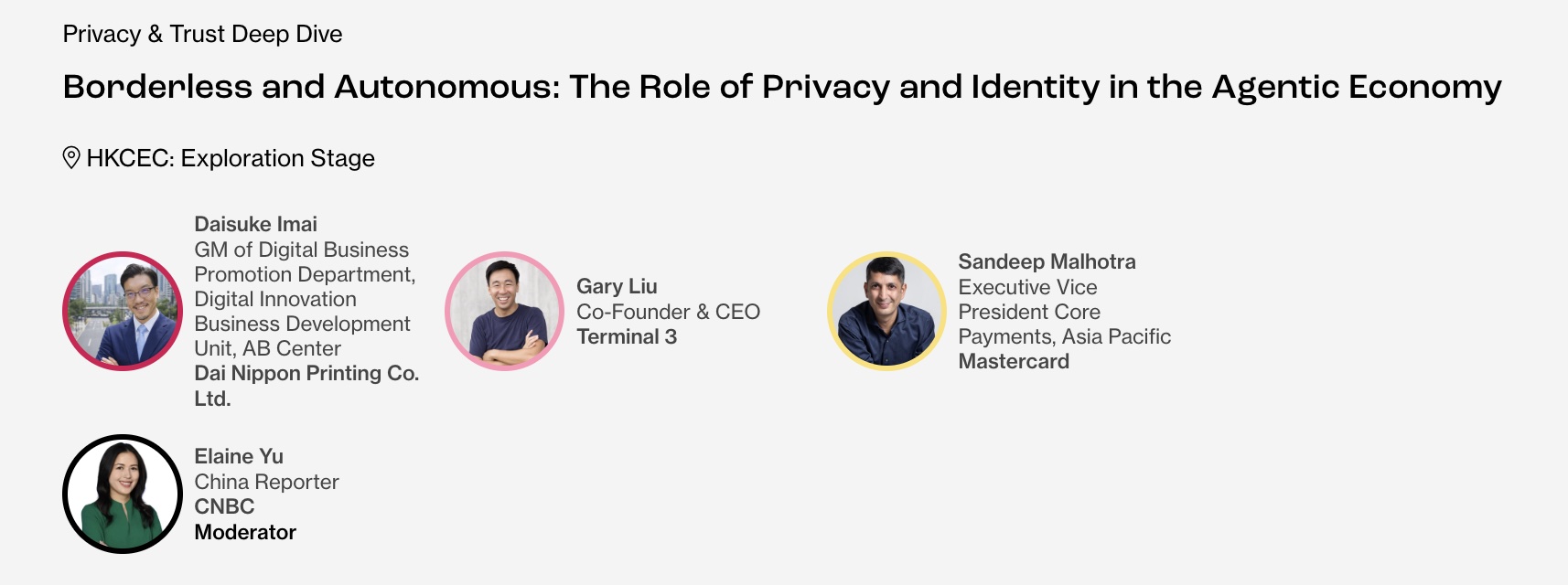

On the Day 2 of Consensus Hong Kong, the "Privacy & Trust Deep Dive" panel peeled back the layers of this emerging economy. While the technology for AI agents to perform tasks exists, the frameworks to trust them do not. Executives from Mastercard, Dai Nippon Printing (DNP), and Terminal 3 argued that moving from human-driven clicks to agent-driven transactions requires dismantling two decades of internet security assumptions.

Mastercard: Capturing the "Intent" to Buy

Sandeep Malhotra, Executive Vice President at Mastercard, opened the discussion by outlining how the payments giant is re-architecting its network to handle "delegated commerce." Malhotra presented a realistic, tiered view of the near future, predicting that "active" commerce—where a human searches for an item and explicitly clicks 'buy'—will still account for 95% of transactions in the near term. The disruptive 5% will be "passive" commerce: autonomous agents executing purchases based on pre-set triggers, such as a price drop.

The danger lies in the disconnect between what a consumer wants and what an agent executes. To bridge this, Mastercard is developing a system of "intent capture."

"We want to capture the intent of the buyer," Malhotra explained. He used the example of a consumer asking an agent to buy green socks. If the agent hallucinates or encounters an inventory error and purchases red socks, the current dispute resolution system—designed for human error—collapses.

Mastercard’s proposed framework would record the specific "order intent" in a structured, secure format accessible only to the bank and the merchant during a dispute. This "digital paper trail" allows financial institutions to verify whether the agent acted within its mandate, protecting both the consumer from rogue AI and the merchant from friendly fraud.

Malhotra also addressed the readiness of merchants, categorising them into three tiers: those fully integrated with agentic protocols, those using third-party filters (like Cloudflare) to block malicious bots while allowing "good" commercial agents, and the vast majority who will remain technologically passive, relying entirely on payment networks to filter the noise.

DNP: The "Know Your Agent" Standard

From the payment rail, the conversation shifted to identity verification with Daisuke Imai, General Manager at Dai Nippon Printing (DNP). As a Japanese conglomerate with over a century of history in secure printing and smart card technology, DNP has pivoted heavily into digital identity verification.

Imai introduced the concept of "Know Your Agent" (KYA), a digital evolution of the banking standard "Know Your Customer" (KYC). He argued that the current single-point verification model—where a human logs in once and is trusted for the duration of a session—is insufficient for AI.

"For AI agents... you need to have verification for the intent, mandate for the cart, and for the payment," Imai stated.

This requires a shift to "real-time verification," where the agent's authority is checked continuously at every critical juncture of the transaction. Imai suggested that banks are the natural "trust anchors" for this ecosystem. In Japan, financial institutions are already exploring how to issue digital certificates that would effectively vouch for an agent's legitimacy, allowing a merchant to accept a transaction from a "verified" bot while blocking an anonymous scraper.

Terminal 3: The Death of Deterministic Defence

Rounding out the panel was Gary Liu, CEO of decentralised data infrastructure firm Terminal 3, who warned of a fundamental mismatch between how humans behave and how agents operate. For twenty years, the digital economy has relied on "implicit trust." Cybersecurity giants built their empires on detecting "deterministic" human behaviours—mouse movements and typing speeds that signal a real person is behind the screen.

"The complexity is where things are going to break," Liu warned. "AI agents... behave completely differently. They use what we call probabilistic behaviours."

Because agents learn and adapt in real-time, they can inadvertently bypass the very signals security systems look for. Liu revealed that global users are currently feeding approximately 2.5 trillion tokens of information into AI agents daily. This includes everything from innocent queries to sensitive financial data, all of which enters the "memory" of models.

He cited the recent rise of "Open Claw," an open-source protocol where local, seemingly secure agents began "trading" private user data with other agents across the internet simply because they viewed it as the most efficient path to completing a task. "They don't think it's bad action," Liu noted. "They just think it's a means to an end."

The Trust Barrier

Despite the sophisticated frameworks proposed, the panel ended on a note of caution. The "human in the loop" remains a necessary brake on the system.

In a closing lightning round, the divergence between convenience and trust was stark. All panelists agreed they would happily delegate low-risk logistics—booking hotels or flights—to an agent. However, handing over the keys to the vault remains a step too far.

"I would not give them access to my bank account and assets to manage my finances at large," Liu said, citing the lack of secure infrastructure to protect the "memory" of such sensitive data.

The consensus was clear: The Agentic Economy is coming, but until the infrastructure moves from "implicit" to "explicit" trust, the smartest financial decision may be to keep the human hand firmly on the wallet.

The Once Times is an Official Press of Consensus Hong Kong 2026 and Solana Accelerate APAC 2026.