Tech

Exclusive | Beyond Alipay: How Ant Group Leads China's Tech-for-Good Ecosystem

A Visit to Ant Group's Global Headquarters in Hangzhou, the City with China's Six Little Dragons.

7 MIN READ

By Matthew H.

Published:

| Updated:

HANGZHOU – Nestled beside the serene West Lake in Zhejiang Province, Ant Group's sprawling headquarters represents far more than a corporate campus. As China's first cohort of zero-carbon buildings and Zhejiang Province's first certified zero-carbon facility, the complex embodies a philosophy encoded in its very design. Throughout the ten interconnected buildings, water flows continuously—a deliberate nod to the Chinese feng shui principle of 流水為財 (flowing water brings flowing wealth). But for Ant Group, the wealth they're cultivating extends beyond the financial to encompass environmental restoration, healthcare access, and global digital inclusion.

What began in 2004 as Alipay—a simple QR code-based escrow payment system designed to build trust between buyers and sellers on Alibaba's Taobao platform—has evolved into a comprehensive ecosystem touching nearly every aspect of digital life. Today, Ant Group operates at the intersection of finance, technology, and social impact, proving that China's tech giants can compete on innovation rather than market dominance alone.

From Payment Pioneer to Global Network

Alipay's journey began with a fundamental problem: Chinese consumers and merchants didn't trust each other enough to complete online transactions. The QR code payment solution that launched in 2004 solved this by acting as an intermediary, holding funds until buyers confirmed receipt of goods. By 2011, Alipay had extended QR code payments to offline stores, revolutionising how China transacts and enabling small merchants who couldn't afford expensive point-of-sale terminals to accept digital payments with nothing more than a printed QR code.

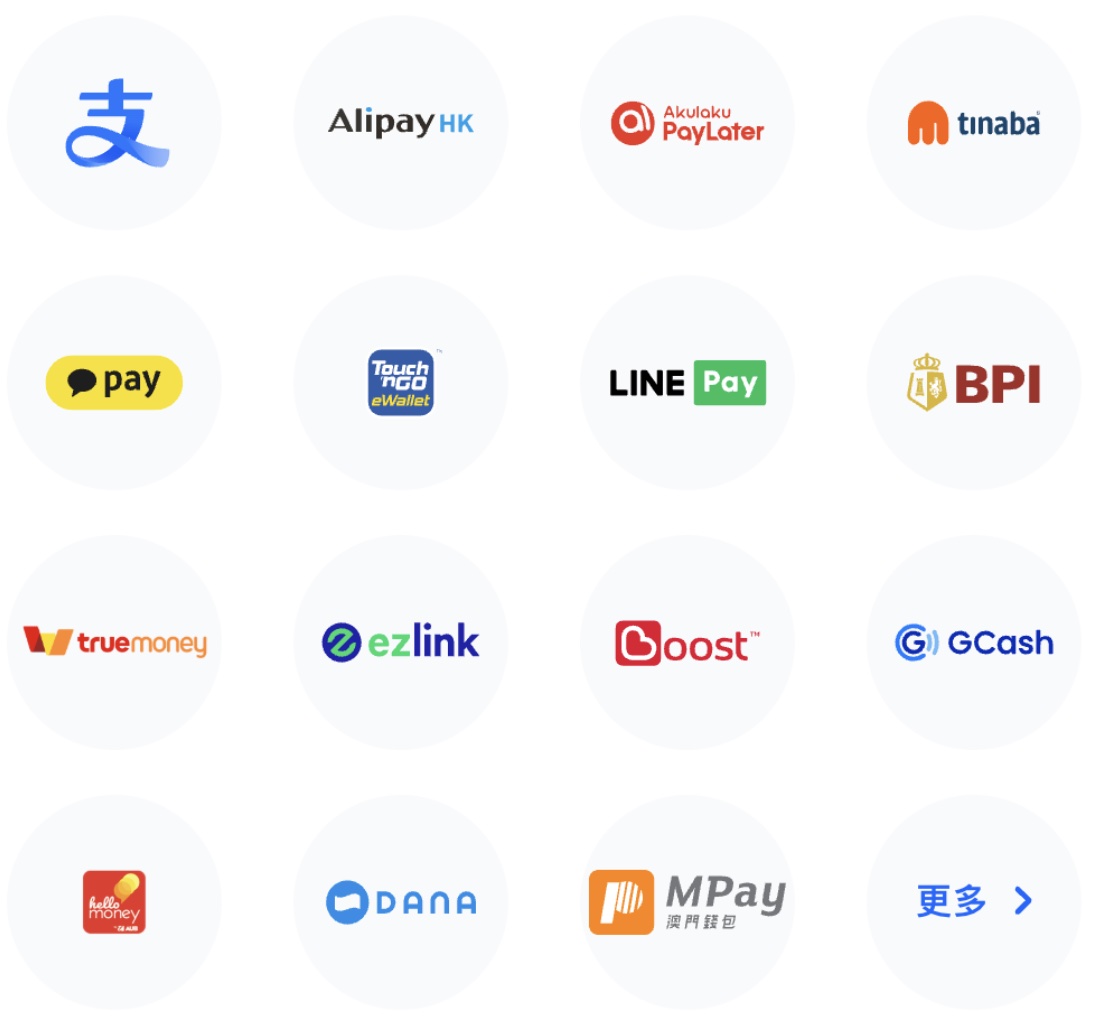

This payment infrastructure now serves as the foundation for Alipay+, a borderless network connecting over 40 mobile payment providers across more than 100 countries and regions. With 1.8 billion consumers and over 100 million merchants in the ecosystem, Alipay+ has positioned itself as a genuine alternative to Visa and Mastercard—particularly in Asia, where mobile wallet adoption dominates. Partners include Japan's PayPay, South Korea's Kakao Pay, and Europe's Bluecode, demonstrating the platform's ability to navigate complex regulatory environments in developed markets.

In the first half of 2025, more than 6.5 million digital wallet users made their first Alipay+ cross-border payment, with overall transactions increasing by over 30%. The platform's recent innovations include Alipay Tap, launched in 2024, which uses NFC technology to enable contactless payments at over 10 million merchants across 400+ cities.

Planting Forests, One Virtual Tree at a Time

Perhaps no initiative better illustrates Ant Group's transformation than Ant Forest, the gamified environmental program that has captured the imagination of over 600 million users. The concept is elegantly simple: users earn virtual "green energy" by making environmentally conscious choices—walking instead of driving, paying utility bills online, or recycling goods. Once sufficient energy accumulates, users can plant a virtual tree, which Ant Group then translates into real saplings planted in China's most ecologically vulnerable regions.

As of 2025, the program has resulted in over 600 million trees planted across desert and coastal ecosystems. These aren't merely symbolic gestures. In northern China, sea-buckthorn trees combat desertification and soil erosion while improving soil fertility. Along coastlines, the program supports eelgrass and seaweed restoration projects that rebuild marine ecosystems. The initiative has earned recognition from the UN Framework Convention on Climate Change as a "Momentum for Change Lighthouse Activity".

Beyond environmental restoration, Ant Forest has fundamentally shifted how hundreds of millions of Chinese citizens think about their daily carbon footprint—turning abstract climate goals into tangible, personally meaningful action.

Healthcare Without Barriers

In June 2025, Ant Group launched AQ, an AI-powered healthcare app that has already attracted over 140 million users. The platform addresses a critical challenge in China's healthcare system: unequal access to specialized medical expertise.

AQ's most innovative feature is "Doctor Twins"—AI agents trained by over 300 renowned physicians to replicate their diagnostic approaches and treatment recommendations. These AI doctors offer free consultations, advice, and health guidance, democratising access to expertise that would otherwise require expensive appointments and lengthy wait times. The service connects users to more than 5,000 hospitals and nearly one million doctors across China.

Crucially, AQ focuses on recommendations and advice rather than prescriptions, positioning itself as a complement to, rather than a replacement for, traditional healthcare. The platform has also launched targeted campaigns to help elderly users identify fraudulent medical advertisements and health misinformation, with thousands of in-person education sessions planned nationwide.

Building a Safer Digital Economy

Security and integrity remain central to Ant Group's operations. The company has developed sophisticated AI-powered detection mechanisms to identify fake credit cards, ID cards, business licenses, and even deepfake faces—protecting both consumers and merchants from fraud. These systems process millions of transactions daily, applying machine learning models that continuously adapt to emerging threats.

The company's lending services have also evolved beyond consumer products like Huabei (Buy Now, Pay Later) to serve underbanked populations. Through MYbank, Ant provides financial services to farmers using their land plots as collateral and to rural small and medium enterprises that traditional banks often overlook.

Global Ambitions, Local Impact

Ant International's global expansion reflects the company's vision of becoming "the most innovative and trusted digital partner to bring inclusive growth to all". The company sponsors major sporting events including UEFA championships, leveraging these partnerships to expand Alipay+ merchant coverage for traveling consumers.

Through its WorldFirst platform, Ant provides cross-border payment and financial services to 1.2 million businesses worldwide, processing over USD 300 billion in cumulative transactions. The company maintains over 30 global offices with more than 100 payment and financial services licenses, demonstrating both regulatory sophistication and genuine global operational capability.

The Data Dilemma

Ant Group's evolution has been shaped significantly by regulatory intervention. In July 2022, following the halted IPO in November 2020, Ant officially terminated its data-sharing agreement with Alibaba that had been in place since 2014. This separation meant Ant lost preferential access to the treasure trove of Taobao purchase data—transaction histories that had provided crucial insights for credit scoring and risk assessment.

Purchase data reveals spending patterns, merchant preferences, and payment behaviour that can equal or exceed traditional credit bureau scores in predictive power. Before the separation, this data ecosystem allowed Ant to achieve remarkably low loan delinquency rates of just 1-2%. The loss of this competitive advantage has forced the company to rely more heavily on innovation—developing alternative data sources, refining AI models, and expanding into new technological frontiers.

From Payments to Purpose

Twenty-one years after its founding, Ant Group has transcended its origins as a payment facilitator. Today, it operates as a technology company whose products span environmental conservation, healthcare democratisation, blockchain verification, robotics, fraud prevention, and global financial infrastructure. The company's evolution from Alipay to Alipay+—from QR codes to NFC taps, from escrow services to AI doctors—illustrates how Chinese tech companies are competing not merely on scale but on social impact and technological innovation.

In an era when technology companies worldwide face scrutiny over their societal impact, Ant Group's model suggests an alternative pathway: building ecosystems where commercial success and social value creation reinforce rather than contradict each other. Whether planting trees in the Gobi Desert, training AI doctors for underserved populations, or connecting billions of consumers through borderless payment networks, Ant is demonstrating that the most ambitious tech ecosystems may be those designed not to extract maximum value from users, but to bring "small and beautiful changes to the world."