By Matthew H.

Published:

| Updated:

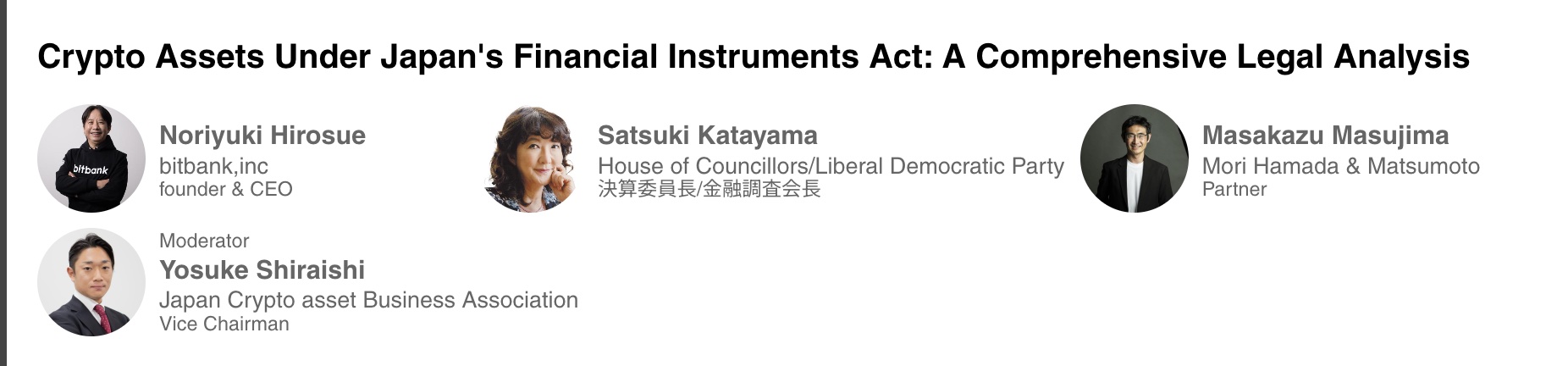

Tokyo – At Asia's premier Web3 conference WebX 2025, held at The Prince Park Tower Tokyo on August 25, Japan's ruling Liberal Democratic Party delivered unprecedented insights into the country's evolving cryptocurrency regulatory framework. In a comprehensive panel discussion titled "Crypto Assets Under Japan's Financial Instruments Act: A Comprehensive Legal Analysis," senior government officials and industry leaders outlined transformative changes that could reshape Japan's position in the global digital asset landscape.

Summary of the Panel Discussion can be found here.

The panel featured Satsuki Katayama, House of Councillors member and Chair of the LDP's Budget Committee and Financial Research Commission; Noriyuki Hirosue, founder and CEO of leading Japanese crypto exchange bitbank; Masakazu Masujima, partner at prestigious law firm Mori Hamada & Matsumoto; and Yosuke Shiraishi, Vice Chairman of the Japan Crypto Asset Business Association, serving as moderator.

Government Signals Commitment to Historic Tax Overhaul

The most significant revelation came from Katayama, who confirmed the government's serious commitment to comprehensive crypto tax reform that could transform Japan into Asia's leading crypto hub. "Japan's current tax rate on crypto assets is as high as 55%, but if crypto assets were transferred from the Payment Services Act to the Financial Instruments and Exchange Act, the tax rate could be reduced to 20%, in line with the stock tax rate," she stated.

This dramatic tax reduction represents one of the most aggressive crypto-friendly policy shifts by any major economy. Katayama emphasized the political momentum behind this initiative: "This reform is expected to be implemented within one to two years, and we expect it to take effect soon. The direction of this reform has been decided by the Cabinet, which usually means a strong push forward." However, she acknowledged implementation challenges, noting that "since the LDP has lost its parliamentary majority, we will need to negotiate with other political parties".

The reform gains additional significance with Prime Minister Shigeru Ishiba's recent statement calling digital assets "extremely important" for Japan's economic future, signaling top-level government support for the Web3 sector.

Strategic Regulatory Restructuring Under FIEA

The proposed regulatory restructuring represents a fundamental paradigm shift in how Japan approaches cryptocurrency oversight. Currently, crypto assets are classified under the Payment Services Act as payment instruments, subjecting them to progressive taxation reaching 55% when combined with local taxes. The new framework would reclassify cryptocurrencies as financial instruments under the Financial Instruments and Exchange Act (FIEA), aligning their regulatory treatment with traditional securities.

Masujima provided crucial legal context, explaining that this transition would address significant gaps in current regulation: "The key phrase here is that everyone properly purchases and is treated fairly, contributing to the asset formation of the citizens. For Cryptocurrency to step up in this regard, by being included under the Financial Instruments and Exchange Act, we can properly address areas that the current law has not yet reached."

The lawyer emphasized striking similarities with U.S. regulatory developments: "This matter is actually very close to what the U.S. GENIUS Act aims for. The GENIUS Act in the United States now positions crypto assets as digital commodities." The GENIUS Act, signed by President Trump in July 2025, establishes the first comprehensive federal framework for stablecoins, requiring 100% reserve backing and strict regulatory oversight.

Market Performance and Growth Potential

Japan's crypto market shows both tremendous promise and untapped potential. According to data presented at the conference, while global cryptocurrency market capitalization expanded from $872 billion to $2.66 trillion, Japan's domestic trading volume increased from $66.6 billion in 2022 to an estimated $133 billion in 2025—roughly doubling while global markets tripled. This performance gap underscores how restrictive taxation has constrained Japan's market development relative to its economic scale.

Hirosue offered the industry perspective on regulatory transition: "From the perspective of an exchange, a positive aspect is that the volume of trades could increase. As Ms. Satsuki Katayama mentioned earlier, there is a possibility of tax changes, so the idea is that if these are combined as a set, it would be quite beneficial."

However, he acknowledged implementation challenges: "The obligations will also increase considerably. After all, the level of the Payment Services Act and that of the Financial Instruments and Exchange Act differ." Despite concerns, Hirosue expressed industry commitment: "If a trading infrastructure is established in Japan under the separate taxation system this time, I believe that businesses must properly acknowledge and respond to it."

JPYC: Japan's Stablecoin Innovation

A significant development highlighted during the panel was Japan's approval of JPYC, the country's first regulated yen-denominated stablecoin, which received FSA approval just days before the conference. This milestone represents a stark contrast to the regulatory approaches of other major economies.

JPYC vs. Global Stablecoin Leaders

JPYC's regulatory-first approach differs fundamentally from market leaders USDT and USDC, which achieved massive adoption before comprehensive regulation. While USDT dominates with $164.53 billion in circulation and USDC holds $64.97 billion, JPYC aims to issue ¥1 trillion ($6.78 billion) over three years under strict FSA oversight.

Key Differentiators: Government vs. Corporate Stablecoins

JPYC's government-sanctioned structure contrasts sharply with recent corporate initiatives like Trump's USD1 stablecoin, launched through World Liberty Financial. While USD1 has rapidly scaled to $2.1 billion circulation through high-profile partnerships, including a $2 billion Abu Dhabi investment deal, it operates under less stringent oversight than Japan's framework.

The distinction highlights Japan's cautious, regulation-first approach versus the U.S. model of market-driven adoption followed by regulatory catch-up through the GENIUS Act.

Addressing Market Integrity and Insider Trading

A critical component of the proposed FIEA framework involves establishing comprehensive rules around market manipulation and unfair trading practices—areas notably absent from Japan's current crypto regulatory structure.

Masujima explained the comprehensive approach: "When they talk about regulating insider trading, even in papers from the Financial Services Agency, it refers to a series of unfair trading practices that are already said to exist in the U.S., and the intention is to prohibit them or establish penalties, as well as supervisory tools."

The discussion highlighted specific prohibited practices including "market manipulation, pump and dump schemes, front-running, and wash trading," positioning Japan's approach in line with international regulatory trends from Europe and South Korea. This regulatory alignment becomes particularly important as Japan seeks to attract institutional investors who require robust market integrity frameworks.

International Competitiveness and ETF Development

The panel addressed Japan's lagging position in crypto ETF development compared to the United States, where Bitcoin and Ethereum ETFs have gained significant traction. "ETFs are not yet available here, but over there, ETFs are very popular. Bitcoin and similar cryptocurrencies are indeed the most realistic way for investment beginners to enter the Cryptocurrency space," noted one panelist.

Katayama framed the regulatory reforms within broader economic strategy: "Most people who actually have it are probably under 40, and although it depends on how it's structured, the units are also very low. In that case, within the concept of a nation built on asset management, it takes on an entirely different meaning and enables various actions to be performed instantly."

The reforms align with Japan's broader push to establish itself as a Web3 hub, competing with regulatory frameworks in other major economies while building on Japan's NISA investment program success that began in the 1980s.

Implementation Timeline and Political Dynamics

The panel indicated that while policy direction has been established, implementation faces complex political realities. With the LDP having lost its parliamentary majority in recent elections, coalition building becomes essential. However, Katayama expressed cautious optimism: "Several parties share our views and we are willing to wait and see how things develop. A final conclusion must be reached before December."

The Financial Services Agency is expected to submit legislative amendments to the ordinary Diet session in 2025, with working groups continuing discussions through the Financial System Council. The timeline aligns with Prime Minister Ishiba's commitment to finalize new crypto tax policies by June 2025.

Traditional Finance Integration and Future Outlook

The panelists expressed strong optimism about Japan's crypto future under the new regulatory framework, particularly regarding traditional finance integration. Hirosue emphasized potential for cross-sector collaboration: "Currently, there is the topic of Stablecoins, and recently there was talk from SBI Holdings about tokenizing stocks. The wonderful thing about Crypto is that it can visualize and represent anything."

"By fully embracing on-chain technology, the existing financial system will become much more efficient. Likely, by combining the strengths of traditional financial institutions and the crypto industry, new financial innovations will emerge," he projected.

Looking ahead, Masujima projected comprehensive ecosystem development: "Once accomplished, I believe the entire ecosystem will operate on a much larger scale with Stablecoins, Cryptocurrencies, and Security Tokens. This is the vision we should all aim for from next year onward."

Conclusion: A Watershed Moment for Asian Crypto

The WebX 2025 panel discussion represents a watershed moment in Japan's crypto regulatory evolution and could have profound implications for Asia's broader Web3 development. The proposed tax reduction from 55% to 20%, coupled with comprehensive FIEA integration, positions Japan to become one of the world's most competitive crypto jurisdictions.

Katayama's closing remarks captured the transformative potential: "Various people, including Mr. Noriyuki Hirosue, have such scattered professional experiences, which did not exist in traditional Japanese financial institutions. Well, since around 2000, due to unavoidable circumstances leading to that situation, I believe a very interesting and creative trend has emerged even in Japan."

The confluence of regulatory clarity, tax reform, stablecoin innovation, and traditional finance integration could establish Japan as the premier destination for institutional crypto investment in Asia. With the government's top-level commitment and industry readiness, Japan appears poised to transform from a crypto laggard into a global leader, potentially influencing regulatory approaches across the Asia-Pacific region.

The success of these reforms could serve as a model for other Asian economies seeking to balance innovation with regulatory oversight, making Japan's regulatory evolution one of the most significant developments in global crypto policy for 2025.