By Matthew H.

Published:

| Updated:

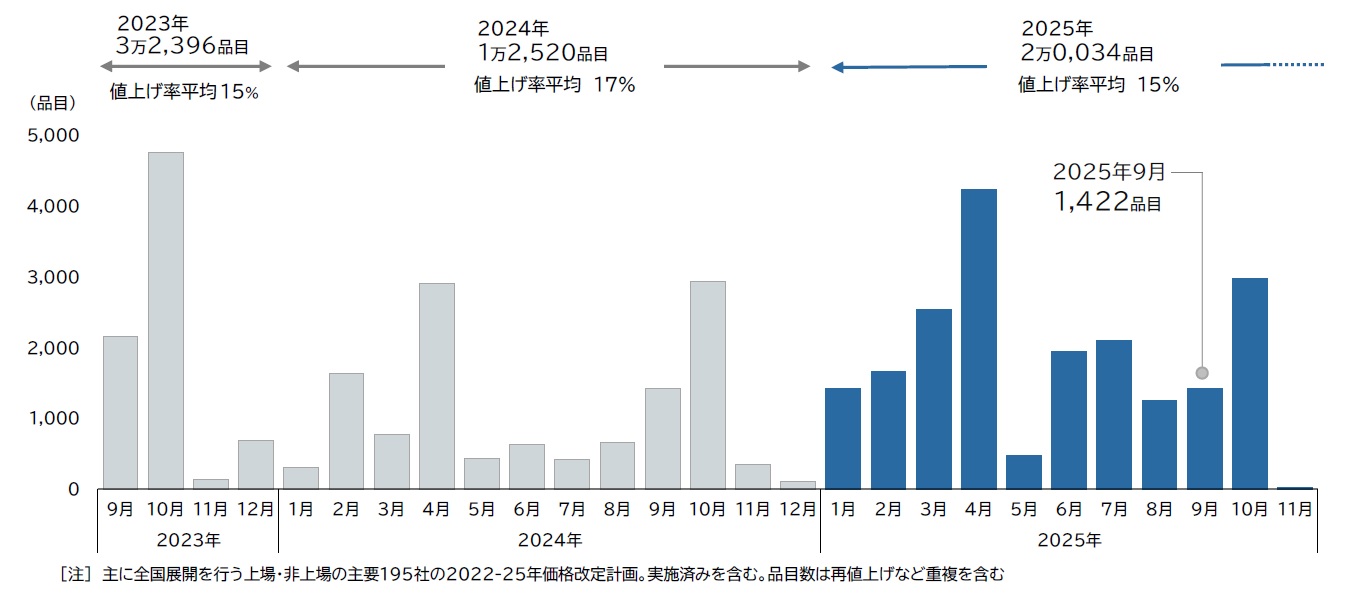

Food and beverage prices in Japan continued their climb in September 2025, with 1,422 items experiencing price hike according to new research by Teikoku Databank (帝国データバンク). This marks the ninth consecutive month of year-over-year growth and signaling a shift toward sustained domestic inflation.

The September figures represent a modest 0.6% increase from the same month in 2024, when 1,414 items saw price hikes. However, the consistency of the upward trend is notable, with single-month increases exceeding 1,000 items for four consecutive months.

Seasonings Lead Price Increases

September 2025 food and beverage price increases totaled 1,422 items, with an average price hike of 14% per increase. This represents a 0.6% increase (+8 items) compared to September 2024's 1,414 items, extending the consecutive growth streak that began in January 2025 to nine months—the longest period since data collection began in 2022. Monthly price increases have exceeded 1,000 items for four consecutive months.

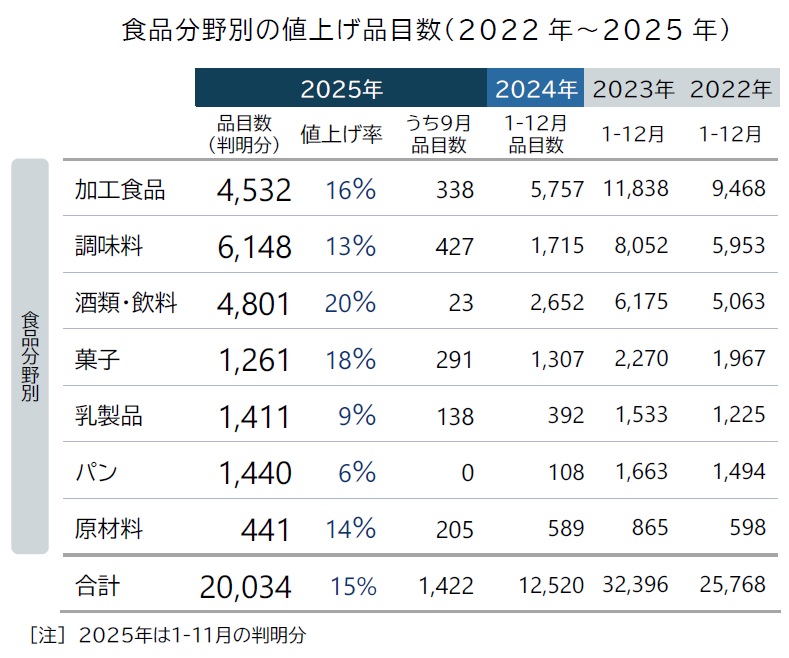

By food category, "seasonings" led with 427 items, primarily consisting of sauces, mayonnaise, and dressing products. "Processed foods" followed with 338 items, including various frozen foods and processed seafood products. "Confectionery" accounted for 291 items, featuring chocolate and potato chip products, while "dairy products" contributed 138 items, including frozen dessert products that saw simultaneous price increases. "Raw materials" reached 205 items, driven by canola oil product increases, marking the first time this category exceeded 100 items monthly in 11 months.

For 2025 overall, cumulative price increases through November announcements reached 20,034 items, representing a 60.0% increase over 2024's total of 12,520 items. This marks the first time the annual total has exceeded 20,000 since 2023's 32,396 items. The average price increase rate of 15% remained slightly below 2024's 17% level.

By category, "seasonings" dominated with 6,148 items—a dramatic increase of 4,433 items (+258.5%) compared to 2024's 1,715 items, making it the second-highest annual level since 2022. "Alcoholic beverages and drinks" reached 4,801 items, encompassing soft drinks, beer, sake, shochu, and wine, representing an over 80% increase from the previous year. "Processed foods" totaled 4,532 items, notably including frozen foods, packaged rice, and seaweed products.

Multiple Cost Pressures Drive Increases

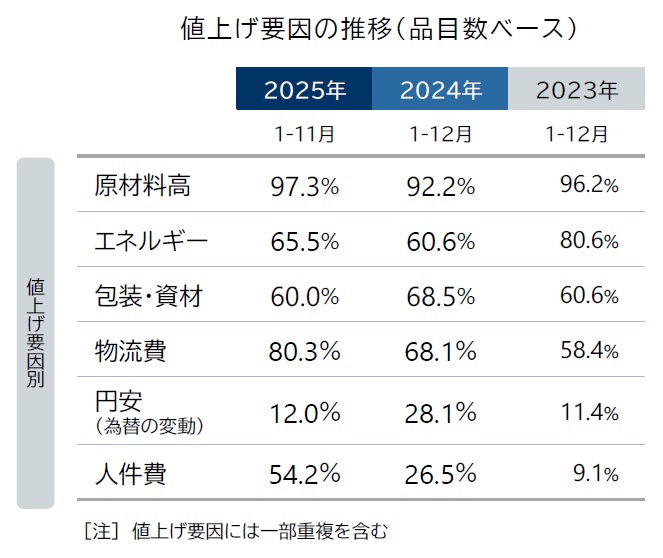

Multiple factors contributed to the increases, including rising raw material costs, increased production costs from higher utility expenses, labor cost increases due to worker shortages, and elevated logistics costs. Material-based factors ("raw material costs") accounted for 97.3% of all increases, while "energy (utilities)" affected 65.5%, "packaging and materials" 60.0%, "logistics costs" 80.3%, and "labor costs" 54.2%—all exceeding half of cases.

Notably, "logistics costs" and "labor costs" both increased significantly from the previous year, while "yen depreciation" as a factor dropped substantially to 12.0% from the previous year. This shift indicates that food and beverage price increases are now driven primarily by domestic economic factors rather than external pressures.

Outlook Points to Sustained Pressure

October is projected to see over 3,000 items increase for the first time in six months, suggesting price increases are becoming "normalized." Japan's 2025 food and beverage price increases reflect intensifying domestic economic pressures, including raw material costs, logistics expenses, and wage-driven labor costs—factors with high persistence.

Unlike 2023-early 2024's price surge driven by external factors such as international wheat and cooking oil price spikes and rapid yen depreciation, the current trend represents a shift toward sustained, domestically-driven inflationary pressures. This necessitates continuous price adjustments, contributing to the significant increase in price hike items compared to the relatively controlled previous year.

Current developments include Japan's minimum wage reaching an average of 1,118 yen nationwide for fiscal 2025—a 6.0% increase from the previous year—with all prefectures expected to reach four-figure minimum wages. Logistics costs continue rising due to the "2024 problem" and ongoing driver shortages, creating a wage increase-inflation cycle driven by domestic factors.

Food manufacturers are transitioning from temporary cost-push responsive measures to sustained pricing strategies accounting for permanent cost increases, suggesting food and beverage price increases will likely become long-term and permanent fixtures.

Looking ahead, October food price increases are expected to exceed 3,000 items for the first time since April. Annual price increases may reach levels comparable to 2022 (25,768 items), when food inflation first intensified.

The research by Teikoku Databank surveyed 195 major food manufacturers and covered primarily household food products, counting multiple increases of the same product as separate items when they occurred within the same year.